The Politics of Economics

Last month, when Greece failed to make a key debt payment to the International Monetary Fund (IMF), the country landed squarely in default.

In response, the IMF along with the European Commission (EC) and the European Central Bank (ECB) proposed a set of economic reforms that Greek voters subsequently rejected. The next payment is due on July 20, and if that, too, is missed, Greece will remain in default or could leave the European Union altogether.

Meanwhile, some 4,000 miles away, the Chinese economy is experiencing its own challenges. In the past three weeks, China’s stock market has deflated a whopping 30 percent before leveling off, at least temporarily, under the influence of massive government interventions.

How do these developments impact the world economy in general, and the United States in particular? According to UC Santa Barbara political economist Benjamin Cohen, it depends on whether we’re talking about economic consequences, or political.

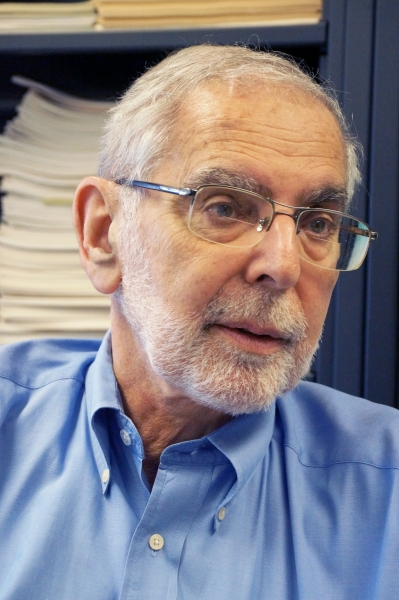

“The stock market decline does represent a significant threat to the Chinese economy, and that does have implications for the U.S.”

“The stock market decline does represent a significant threat to the Chinese economy, and that does have implications for the U.S.”

Benjamin Cohen

The Louis G. Lancaster Professor of International Political Economy

Photo Credit: Sonia Fernandez

“Greece doesn’t pose any direct threat to the U.S. economy,” said Cohen, the Louis G. Lancaster Professor of International Political Economy. “It doesn’t even necessarily pose a direct threat to the European economy because it has a gross domestic product that’s only about 2 percent of the total European Union.”

However, he added, if Greece is forced either to default on its debt or to leave the European Union — or both, and the two are separate issues — the rolling effect could reach other countries that, like Greece, have been forced to undertake austerity measures in order to obtain financial assistance from the rest of the European Union.

“That means Italy; that means Spain; that means Portugal,” Cohen said. “Italy is the third largest economy in the eurozone, and Spain is the fourth. So they become much bigger players and have a much bigger impact on the European economy.” And at that point, the rolling effect would hit the U.S.

“Europe is 25 percent of the world economy,” Cohen explained. “It is collectively our second-largest trading partner. And if Europe starts to have serious difficulties as a result of a contagion effect, the consequences for the U.S. could be serious.”

But how is it that one country can get into such financial hot water? “This is part of a much more general and generic problem,” said Cohen. “Governments borrow money outside their own countries all the time. This has gone on for 500 years. And occasionally they become overexposed and can’t repay their debts.

“There never has been — since banks began in Italy in the Renaissance — a satisfactory mechanism for resolving the debt problems of sovereign governments.”

“There never has been — since banks began in Italy in the Renaissance — a satisfactory mechanism for resolving the debt problems of sovereign governments.”

Photo Credit: Sonia Fernandez

“The problem is that because they are sovereign governments it’s difficult to negotiate a settlement,” he went on. “And there never has been — since banks began in Italy in the Renaissance — a satisfactory mechanism for resolving the debt problems of sovereign governments. Ultimately it has to be settled on the basis of political negotiations.”

Cohen added that the Greek crisis has been going on for five years and a number of defenses have been built up that could contain the economic consequences of a Greek exit or default. What can’t be predicted, however, are the political consequences.

“One of the ironies of the situation is that the ruling parties in Italy and Spain have been vigorously opposed to any kind of concessions to the Greeks,” said Cohen. “You’d think these countries would want to see concessions because then they might qualify for some as well. But the ruling parties would suffer electorally within their counties. If Greece is seen to have gotten a good deal, people in Rome and in Madrid are going to ask why they couldn’t get one.”

Voters in those countries could turn toward more extreme parties — those equivalent to Syriza in Greece — and initiate some major changes in government. That in turn could create serious political consequences in Europe, although the threat to the U.S. is more distant.

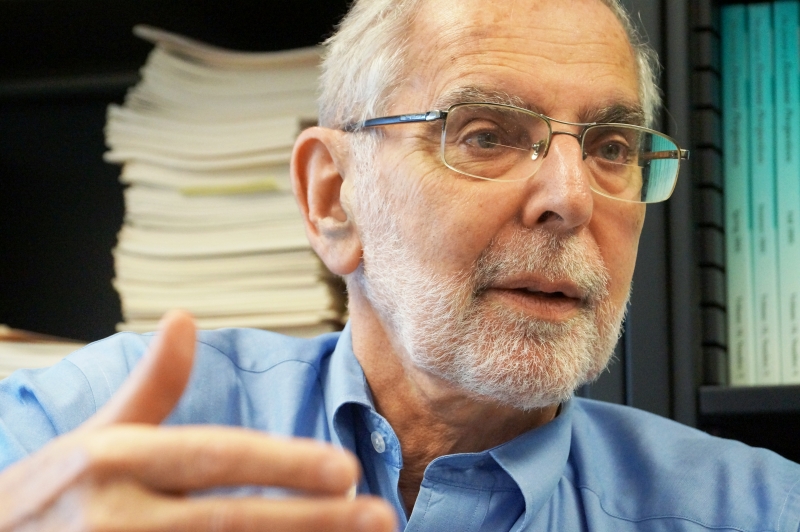

“What we’re talking about is secular stagnation, long-term stagnation.”

“What we’re talking about is secular stagnation, long-term stagnation.”

Photo Credit: Sonia Fernandez

“On the other hand,” Cohen said, “with China it’s a much more serious issue. China’s stock market is not China’s economy, of course, just like what happens on Wall Street and the New York Stock Exchange doesn’t necessarily reflect what’s going on in the broad U.S. economy. But the stock market decline that has occurred does represent a significant threat to the Chinese economy and that does have implications for the U.S. There aren’t as many steps involved as there are in Europe.”

According to Cohen, China’s economy a few years ago was growing at better than 10 percent per year. More recently, however, the rate has been dropping significantly and the Chinese government has been unable to stop it. “It’s still a high rate of growth — 6.5 to 7 percent — but for the Chinese economy this is considered a real slowdown,” he said. “And it’s continuing to drop from year to year.”

Given that China is one of the U.S.’s largest trading partners, that doesn’t bode well. Even more important, China is a major importer of commodities and energy: coal from Australia, iron ore from Brazil, oil from Africa and the Middle East, and foodstuffs from a whole host of different countries. “All these places are going to suffer if China’s economy slows down,” said Cohen. “There will be less demand for their exports.

“We’ve already had that effect,” he continued. “Brazil, for example, which a few years ago was growing at a rate of 5 to 6 percent per year is now in a recession. A lot of the so-called emerging market economies are affected because they had become so dependent on the Chinese market. And that impacts the U.S. because they are major markets for U.S. products.”

“A lot of the so-called emerging market economies are affected because they had become so dependent on the Chinese market. And that impacts the U.S. because they are major markets for U.S. products.”

“A lot of the so-called emerging market economies are affected because they had become so dependent on the Chinese market. And that impacts the U.S. because they are major markets for U.S. products.”

Photo Credit: Sonia Fernandez

The global economic picture that develops is not one of recession, but rather slow and, as Cohen put it, uninspired growth. “The IMF today updated its forecast for the world economic outlook — they do this several times a year — and for this year they kept their forecast, which is for growth of 3.3 percent,” he said. “That’s 1 to 2 percentage points less than what we used to expect of the world economy.

“What we’re talking about is secular stagnation, long-term stagnation,” Cohen added. “It’s what Christine Lagarde, the managing director of the IMF, calls the new normal.”

In response to the sluggish international economy, many countries are taking measures that tend to push down their exchange rates relative to the U.S. dollar, explained Cohen. As the dollar becomes stronger it reduces the competitiveness of American products relative to imports. “So what we’re seeing is a lot of lower-priced imports,” he said. “That’s good news for the consumer who can buy more goods at a relatively low price.”

But for people in the business sectors that produce goods that then have to compete with the lower-priced imports, the situation is grim. “We’ve already seen it,” continued Cohen. “The manufacturing sector has been hurt significantly by the upward movement of the U.S. dollar. The real damage to the U.S. economy is coming through the exchange rate as other countries push theirs down in order to promote their imports. For consumers, this is great. But if I were working in a textile mill in Georgia, I’d be very upset.”

In the short term, China’s stock market slide won’t translate into any visible impact on the U.S. economy; the real effects will manifest later. “If there is, indeed, a negative wealth effect in which Chinese investors suffer 30 to 40 percent declines in their net worth and as a result cut back on their spending such that the Chinese economy declines, we’ll see the impact in terms of the price of imports coming into the U.S.,” Cohen said. “And conversely, for producers of income-competing goods.”

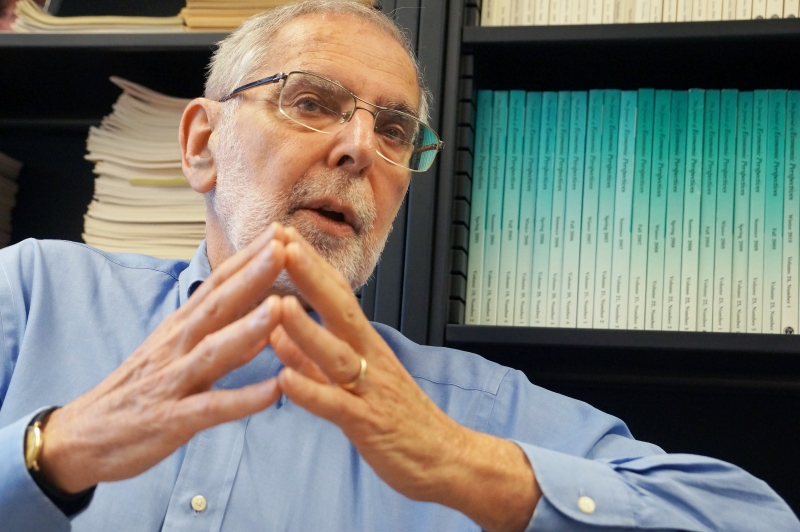

“We went through an episode like this before, at the end of the 1930s. But then World War II came along and turned things around.”

“We went through an episode like this before, at the end of the 1930s. But then World War II came along and turned things around.”

Photo Credit: Sonia Fernandez

Cohen added that he agrees with the school of thought that says secular stagnation is here for the foreseeable future. “We went through an episode like this before, at the end of the 1930s. The Great Depression dragged on for so long, even as late as 1940. But then World War II came along and turned things around,” he said.

“Now we’re in that situation again,” he continued. “The problem is that the sources that stimulated so much growth back in the 1990s and in the first decade of the 21st century are gone.”

And what were those sources? According to Cohen, one was the growth of China, which proved to be an extraordinary stimulus for the world economy, and the other was the information technology (IT) revolution. “But those things are tapering off,” he said. “China, as it approached middle income, was bound to experience some decline. And the IT revolution has sort of petered out as well. There is nothing comparable to the Internet coming over the horizon, no other dramatic and novel innovations.

“So until something new comes along — another IT revolution, another China, or another world war — my own judgment is that the global economy is destined to hobble along at its current pace,” Cohen concluded.