A Grim Outlook

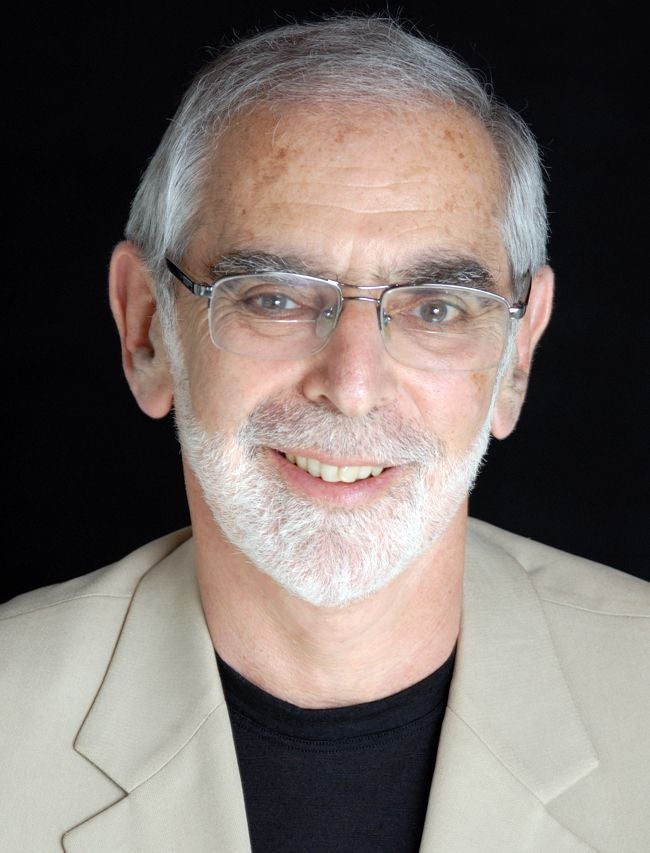

With the Coronavirus forcing most of the country to shelter in place, the once-humming economy has taken a massive hit. Benjamin J. Cohen, the Louis G. Lancaster Professor of International Political Economy at UC Santa Barbara, has some grim news: It’s going to get much worse.

“Right now, we are on the edge of a precipice,” he said.

As Cohen noted, economies everywhere are shutting down as people stay home. Until now, the larger effects on the economy have been muted because businesses and individuals have been able to get by through borrowing or dipping into savings. But that won’t last, he said.

“Without government aid, small and medium-sized enterprises will be forced into bankruptcy, massive layoffs will begin, store shelves will empty,” he said. “Visualize Wile E. Coyote running off the edge of a cliff. For a moment all seems manageable — until he looks down! That’s where we are now. We’re just beginning to realize that we’re about to go into free fall.”

Congress’ $2 trillion stimulus package, Cohen said, was a solid first step to responding to the crisis — and one that represents the seriousness of the situation. After all, he said, Republicans in Congress tried mightily to torpedo then-President Obama’s $850 billion stimulus proposal back in 2009.

“Now opposition was minimal despite the huge price tag and the package was quickly passed,” he said. “So a big thumbs up for size and speed.”

The new stimulus will help in numerous ways, Cohen said, by getting money where it’s most needed: the suddenly unemployed, hospitals and other medical facilities, small and medium-sized business on the edge of bankruptcy, and to state and local governments to cover their additional expenses fighting the virus.

“Samuel Johnson said that ‘nothing concentrates the mind like the knowledge that one will be hanged in the morning,’ ” Cohen said. “Likewise it can be said that nothing concentrates the minds of policy makers like the prospect of another Great Depression.”

But the stimulus also has some serious drawbacks, he said. The $500 billion fund the package created for loans to large corporations has been given to Treasury Secretary Steven Mnuchin for allocation, which, Cohen said, “scares me.”

“It has all the appearance of a gigantic slush fund for the administration's corporate friends,” he said “The Democrats, led by Chuck Schumer and Nancy Pelosi, did manage to get some safeguards written in, including an Inspector General to keep an eye on things and a requirement to report all loans immediately to Congress. But we all know that safeguards are only as good as people want them to be. President Trump has already stacked the deck by appointing a White House crony as inspector general. And he also insisted that he has the ultimate authority to determine what information will be shared by the inspector general with Congress. These safeguards could easily turn out to be little more than words on paper, not really effective constraints.”

Cohen also worries that the package may be insufficient. Given the estimates of 100,00 to 200,000 deaths from the coronavirus, he said, the damage to the economy could be exponentially greater.

“The longer we are forced to shelter in place, the greater the damage,” he said. “More people will run out of savings, more businesses will go under, more public services will go unprovided. It's not at all surprising that we're already hearing talk of a need for another rescue package down the road, possibly as early as late spring or early summer.

In an effort to stem the damage to the economy, the Federal Reserve slashed interest rates near zero, a move called by some as bringing out the “big guns.” Cohen, though, notes that rates were already remarkably low by historical standards.

In the past, he said, the Fed had room to lower rates by as much as 400 to 500 basis points, or 4 to 5 percentage points, which he said could make a real difference. But there was no such “breathing room” for a wholesale cut today, he explained. That’s why the Fed was forced to supplement the cut with a raft of other initiatives, including massive bond purchases (quantitative easing) to expand the money supply, and new loan programs to support the banking system and commercial-paper market.

Is it an effective strategy? That depends on your definition of “effective,” Cohen said. The Fed’s No 1 goal is to prevent the freezing of financial markets that we saw in 2008. It will also be difficult to measure given that it would require comparing it something that didn’t happen, i.e., the Fed doing nothing.

“That is inherently unknowable,” he said. “What we do know is that, at best, the Fed is buying us some time until the politicians in Washington can get their package of fiscal measures up and running. A well-designed fiscal stimulus is what we really need.”

Stimulus or no, Cohen said, the damage to the national and global economies is likely to be deep and long-term.

“My guess is that people are going to stay closer to home for a long time to come,” he said. “That would mean that the hardest hit will be the hospitality industry, entertainment and airlines. I would expect a slew of bankruptcies in these sectors, with a lot of reorganizations to follow. I would also expect to see the death of a lot of Silicon Valley unicorns — novel tech ventures that have never made a profit, depending instead on loans to sustain their growth. On the other hand, I think there will be massive new investment in our health industry and old-age care.”

As for the rest of the world, Cohen said he is convinced the repercussions from the pandemic will lead to a major reversal of the 50-year globalization of the world economy. He said corporations will concentrate on production in their home countries, which will make their governments more protectionist.

“Donald Trump has made tariffs respectable again — or at least less disreputable,” he said. “The liberal multilateral trading system laboriously built up after World War II will go the way of the dodo.”

Recovery won’t be quick, Cohen said. Rather than a V-shaped recession — deep but short — he expects a long, slow and painful return to anything resembling normal.

“There is no doubt that we are moving toward a deep recession,” he said. “As I said, we’ve gone off the edge of a cliff, and the free fall is just beginning. The only question is how far we will fall. The most dire predictions suggest that the unemployment rate could soar as high as 20 percent. That’s not a recession, that’s a depression.”