The Brexit Muddle

Two years after voters in the United Kingdom narrowly decided to leave the European Union, the process is awash in intraparty squabbling that could lead to what a UC Santa Barbara scholar deemed “chaos.”

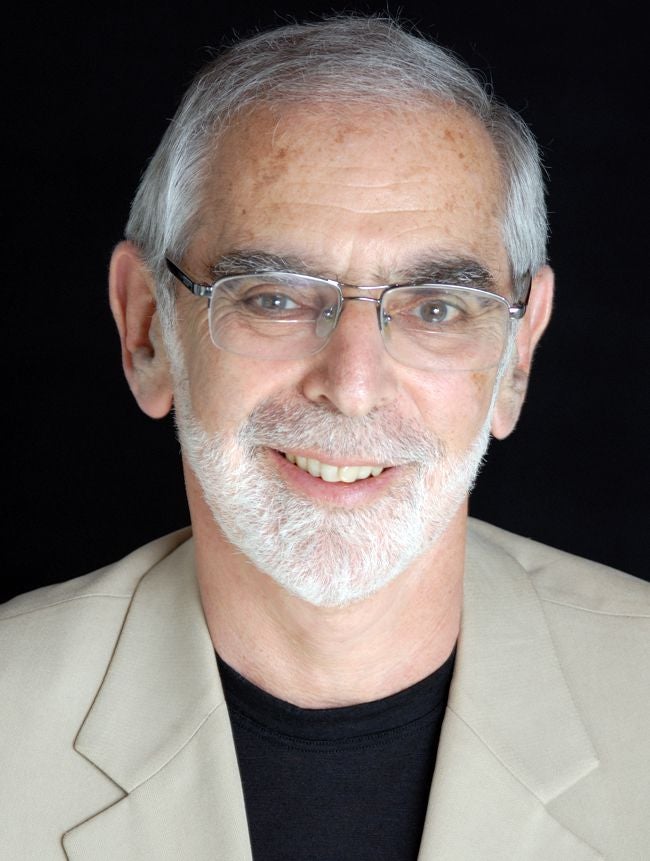

Benjamin J. Cohen, the Louis G. Lancaster Professor of International Political Economy in the campus’s Department of Political Science, said the recent resignations of Brexit secretary David Davis and Foreign Secretary Boris Johnson roil the already long-delayed preparations to negotiate the U.K.’s exit from the EU.

“The resignations of Johnson and Davis, along with several junior ministers, will make a difficult Brexit process even more difficult,” Cohen said. “Britain is scheduled to leave the European Union at the end of March next year — less than nine months away — and Prime Minister Theresa May’s government has not even yet been able to agree on its initial bargaining position.”

A week before the resignations, May had gathered her cabinet at Chequers, the prime minister’s country residence, to work out a set of proposals that would form the basis of a negotiation strategy. May thought she had a consensus. And then Davis and Johnson quit, putting the prime minister in a difficult spot with little leverage in negotiations with EU officials, who had already complained the proposals amounted to “cherry picking.”

May, Cohen said, “will have less room to maneuver. Worse, the resignations could lead to a challenge to her party leadership, which has long been hanging by a thread. Conceivably, it could even lead to a vote of no confidence in Parliament, which might trigger a call for new elections. Most people think that would result in a new Labor government replacing the Tories.”

All that political drama is delaying negotiations with the EU, increasing the risk that the March deadline could arrive with no final agreement about what happens next, he said.

“Commentators refer to this is as the ‘cliff edge,’ ” Cohen explained. “Britain would be suddenly on the outside, no longer a beneficiary of the EU’s freedom of movement for goods and services. The result could be chaos.”

For those who think the U.K. might reconsider Brexit, given that some people expressed regret for voting to leave, Cohen has sobering news: That’s not going to happen. Popular support for leaving hasn’t declined significantly, despite the growing evidence of how costly leaving the EU could be in purely economic terms.

“Support for Brexit has been concentrated in the English countryside and is motivated by both a distaste for immigrants and a nostalgia for ‘little England,’ ” Cohen said. “Those feelings haven’t changed. The second thoughts we read about have been expressed mainly by the so-called Remainers, who were always opposed to Brexit.”

And while those Remainers would like to see a new referendum, he said, there’s little support for it. Instead, others want to ensure that the Parliament will have a say in shaping any final agreement with the EU. The hope is to make Brexit as “soft” as possible — that is, as close as possible to what exists now, including continued British membership of the EU single market. Brexiteers, however, are deeply opposed to such an approach.

“That’s what Johnson had in mind when, in his resignation letter,” Cohen said, “he accused Theresa May of leading Britain into a ‘semi-Brexit’ with the ‘status of a colony.’ Brexiteers prefer a ‘hard’ Brexit, meaning cutting as many ties with the EU as possible.”

For any other country that harbors an urge to follow the U.K. out of the EU, May’s troubles are a warning about the sheer difficulty of an exit, Cohen said.

“As the British have learned,” he said, “membership involves an enormous range of formal links that are extraordinarily difficult to unwind. It’s like Hotel California — relatively easy to enter but seemingly impossible to leave.”

Looking ahead, a muddled Brexit effort is not good for either the U.K.’s or the EU’s economy, Cohen noted. With the outcome of the British negotiations unclear, many companies across the Atlantic are delaying investment decisions, which in turn could depress economic activity more generally. The reason is simple, he said: “Business hates uncertainty.”

Although the U.S. isn’t affected by Brexit at the moment, our time may come, Cohen said, because the EU (including Britain) is America’s biggest trading partner. “Uncertainty is bound to affect investment decisions in the United States as well,” he said.